Compiled by Beth Smith, Chair of Membership & Chapters Committee

At the RTAM Chapter Presidents Meeting in May 2017, retired teachers were asked what they would like to tell active teachers about retirement. The material provided below is informational in nature and not formal advice.

- Remember that you will retire whether you like it or not. Retirement is great if you prepare for it. Make sure that you have something to do like being part of an RTAM local group to get involved with other like-minded individuals.

- Financial planning is essential – be prepared. Start saving early – pay yourself first.

- Plan for your retirement at least 5 years before you retire.

- Keep in touch with RTAM – KIT (publication), local RTAM chapter, be vigilant on retired teachers’ issues as a group.

- Do things that you have always wanted to do.

- Travel – see the world.

- Socially, stay involved.

- Prepare yourself for “free” evenings – no school work to do.

- Plan for it- retire to not from, enjoy it.

- Be sure you have other income, so you are not relying solely on pension income i.e. RRSPs and investments.

- Don’t lose touch with other teachers – both active and retired. Consider other avenues for using your knowledge – work with adults, volunteer, continue learning.

- Attend retirement seminars in each decade that you work and really pay attention to advice given about attaining the retirement that you desire.

- Check the TRAF pension options carefully.

- A lot of information is available from TRAF, no need for educators to be oblivious to retirement.

- When you are thinking of retiring in a few years, ask TRAF for a printout of your projected pension amounts. Pick the most likely and live on that amount. Bank the rest and you will have a little nest egg – and if you can live on your “projected pension” you can afford to retire.

- Understand that MTS no longer represents you the day after you retire.

- Do not make major decisions quickly (i.e. selling your home, moving, etc.)

- Be selective in your first year of retirement as to what you volunteer to do. Find something you like to do and do it.

- The best thing about retirement is that you almost never have to set your alarm clock.

- Think about how you are going to fulfill your need to be relevant (needed, and a contributing member of society).

- Discuss your retirement “budget plans” with someone who will critique it positively for you.

- What I enjoy most is the freedom and flexibility to choose how I want to spend my days.

- Do not rush into retirement because of internal/external stressors – retire on your “own terms”.

- Don’t wait to enjoy life when “you retire” – retirement is just an extension of enjoying life – another variation.

- Retirement is not an “event” – it is part of a journey.

- Don’t buy “work” clothes in the year before you retire.

- Keep a list of goals that range in easily attainable to difficult ones. (Bucket List).

- If planning to start another business after retirement – start while you have a steady income.

- Rewrite your resume highlighting skills learned from teaching. You have many skills that are wanted in other aspects of your community.

- Try to get rid of clutter long before your next move.

- Be debt free when you retire.

- Retire your mortgage early.

- Get physically active before retirement and continue after your retirement.

- Retire when you are happy with what you are doing.

- No dental, no glasses. Get it done as much as possible before you retire.

- Buy big ticket items before you retire.

- Haven’t heard anyone regret retirement!

- Attend the pre-retirement seminars – they give valuable information.

- Give yourself time to enjoy retirement during the first years – don’t get too involved in volunteering or subbing.

- Don’t feel obligated to accept sub jobs – you can say no without guilt.

- Social isolation is the biggest problem in the older population.

- Find your passion(s) and follow it/them.

- You really need a focus – hopefully worthwhile.

- Try new things.

- You may not need as much money as you think.

- Manage your personal finances carefully – know your financial situation clearly. Plan for daily living – priorities, activities.

- The importance of health, wellness and economic security concerns. Don’t just focus on the pension options.

- What is covered July, August – after June retirement?

- Watch your subbing days.

- It could be a long period and your health rarely gets better as you age, so do those active things early on in your retirement career.

- You will never be making more money than you are now – before you retire.

- Select your retirement activities carefully – you may be creating unrealistic expectations for yourself.

- Stay involved in retirement – there is a world of new experiences out there and your teaching skills will come in handy in many of them. Try something new.

- The time in retirement goes very fast. Do the things you can and wish to do now as health is not always controllable.

- Be ready to be very busy if you decide to be involved.

- You can make a difference as an “active” retired member of your local and provincial associations.

- Watch how much volunteering you do – once you start, people won’t want you to step down. Learn to say no some of the time.

- Get out and enjoy it – don’t sit around and plan to go tomorrow.

- Get another paid job.

- “Listen” this is important – get involved with other organizations.

- Stay active and informed with the community.

- I did not realize how much fun it would be and how much more relaxed I would be.

- Your pension does NOT increase at the rate of your food, housing, utilities, etc.

- Always have some dollars in reserve in case needed.

- Know exactly what your financial position will be when one spouse dies. Particularly if one doesn’t have a secure pension plan.

- Retirement is the time when you, rather than others, finally get to plan your life.

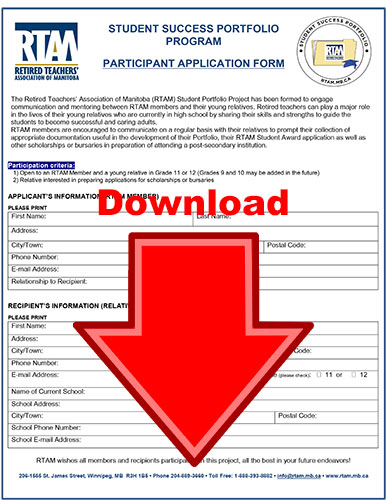

As part of our New Horizon for Seniors Grant, we allocated some funds for a research study to help us determine the effectiveness of our program. We recently were matched with a U of M Masters student to be our researcher. Andrew Augustyn is very excited to do this research as he is interested in the theme of mentoring for his M.Ed. thesis. RTAM has sent out letters of invitation to hold interviews on his behalf to those who have signed up for the program. He will be doing two interviews this fall as part of his Qualitative Research Course and then completing our research with eight more interviews in February in order to meet our Grant Report requirements due in March. Enjoy reading his biography below.

As part of our New Horizon for Seniors Grant, we allocated some funds for a research study to help us determine the effectiveness of our program. We recently were matched with a U of M Masters student to be our researcher. Andrew Augustyn is very excited to do this research as he is interested in the theme of mentoring for his M.Ed. thesis. RTAM has sent out letters of invitation to hold interviews on his behalf to those who have signed up for the program. He will be doing two interviews this fall as part of his Qualitative Research Course and then completing our research with eight more interviews in February in order to meet our Grant Report requirements due in March. Enjoy reading his biography below.